cn23 form uk

Goods up to 270 require customs label CN22. This is why some smaller online retailers paused selling to UK based customers as it would mean accepting extra costs.

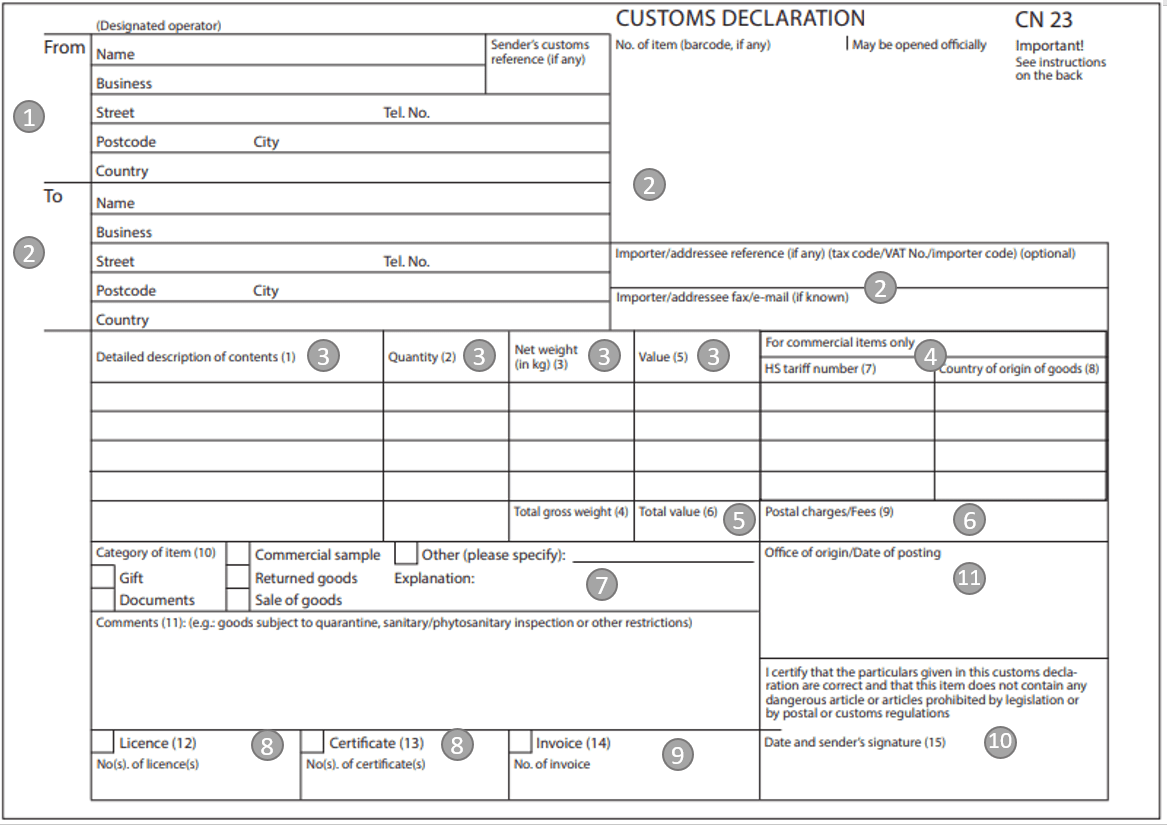

The Customs Form Made Easy Step By Step Guide For Cn23 Byrd

The SAD was introduced to control goods arriving from.

. The information and use of this invoice functions similarly to CN22. Left arrow to indicate to go back Back to Working differently. This is fixed to the package and contains information such as the sender and recipients details and whether its a gift. Automatically generate your CN23 form and commercial invoices along with HS codes and your shipping labels.

The CN23 form is similar to the CN22 but it contains more details. Customs declaration form CN23 UK for higher value artworks. Also include the customers telephone number because in some cases it may be necessary to call. They are mandatory for all gifts and goods being sent internationally from England Scotland or Wales anywhere outside the UK if posting from Northern Ireland they are only needed for posting to non-EU destinations.

Why dont I need to fill in a customs form if Im sending from Northern Ireland to EU destinations. Creating a CN23 in EdgeCTP and EdgeDocs b How to fill in a CN23 Form. Read our quick guides to help you prepare your franking mail for posting collection or dropping off. Left arrow to indicate to go back Back to Working differently.

Since the UK is no longer part of the EUs VAT regime the new rules require EU sellers to register with HMRC to account for VAT in order to sell to the UK. Where I pay the customers VAT and pay their relevant tax authortiy. Activate multiple couriers such as FedEx Hermes Royal Mail DPD and others and allow your customers to pick their most preferred shipping method at checkout to increase conversions. Digital innovation in the UK.

Winning the talent war. Get help with customs declaration forms including when to use them which countries require them and what to include on the form. Choose New Customs Declaration Custom Declaration CN23 to bring up a new CN23 data entry form. If your parcel is worth 270 or less then youll need to fill out a CN22 form with a short description of the packages contents weight and value.

To support your claim to import tax you should keep the charge label postal wrapper and any customs declaration that is form CN22 or. 1 reason why our clients. To help us improve GOVUK wed like to know more about your visit today. All items sent to Guernsey from the UK should also have a completed and signed customs declaration form CN22 or CN23 attached in order to comply with customs requirements.

It is a binding customs document that mainly contains information about the contents of the package and the agreements made such as who pays the customs costs. See All Integrations Integrate more than 50 couriers to your ecommerce store using our cutting edge shipping software. When sending parcels to the UK from Spain the sender should fill in a customs form CN22 or CN23 which are available at the post office. You also need to include a description of the contents which takes away the element of surprise for.

Learn how to send your franked mail. Help us improve GOVUK. The type of form you need to fill out depends on the value of the items you are sending. Goods over 270 require customs declaration CN23 adhesive plastic wallet SP 126.

Your name and address. Sending a parcel to Australia requires some extra documentation compared to shipping domestically in the UK or to elsewhere in the EU. Wasnt really expecting sales form outside the UK. If you are unable to print a returns form dont worry simply include a handwritten note inside the parcel with the following details.

Should you require specific customs advice and the latest rules please visit the. Import VAT customs duty and handling fees for orders over 135. Jan 7 2015 2317 397. The commercial invoice is also an export document that you add to all commercial shipments outside the EU.

The other options such as item for sale may affect the level of duty. A CN23 form is always accompanied by a CP71 dispatch note. Our system allows you to quickly choose and switch between couriers through your back office system offering you the ability to open your business up to a global market. A step-by-step guide to the CN23 form.

The main customs form used in international trade is known as the Single Administrative Document SAD also known as form C88 in the UKTraders and agents can use the SAD to assist with declaring import export transit and community status declarations in manual processing situations. Just CN22 it and get the customer to pay the import VAT. The senders full name and address must be written on the front of the item. Winning the talent war.

So I never bothered to register for the prepaid VAT scheme. The CN23 is a customs form used when sending gifts and goods abroad worth more than 270 with Royal Mail. If your order is over 135 you have. The ATA Carnet for artwork being shipped for exhibition only.

Digital innovation in the UK. Details of which can be found here. The 28 EC countries are. Fill in the address information of the sender and receiver.

These custom documents have information about the goods you want to ship including their cost the sender and receivers details and which parties are involved in the shipping. Well send you a link to a feedback form. Nov 8 2021 2 Nov 8 2021. The original order number can be found in My Account.

Domestic UK and International couriers all under one roof. This form must be signed by the sender and attached to the top left hand corner of the item. It should be attached using the plastic. What are my options now.

To increase your chances of successful delivery be sure to provide all the address details you know. We offer paperless UK returns via Asda ToYou and Hermes which only require a QR code to be presented and scanned at your local store. You can find links to the necessary forms and some details on what to include below. For packages being sent from the UK to Italy the CN22 or CN23 form is required.

Currently there are no declaration requirements for goods moved directly between Northern Ireland and the European Union but customs forms are still needed if. Find out how and when to fill out a customs declaration form if youre sending commercial mail to other countries. Creating a future-ready workforce. Left arrow to indicate to go back Back to Working differently.

With the CN23 data entry form visible you have the Help Text OnOff to guide you for each field entry as well as the Instructions showhide for complete instructions. Yes we have blank CN22A customs form and CN23 customs form available to download print and fill in by hand. Please make sure you use the correct one. CN22 and CN23 documents are exclusively required when sending goods outside of the UK when shipping through the Royal Mail.

International couriers such as DHL or DPD do not require a CN2223 but rather a Commercial Invoice or their own variation of a customs declaration form. Full shipping automation The no. For items with a value up to 270 use customs declaration form CN22 pdf 39405 KB For items with a value over 270 use customs declaration form CN23 pdf 22798 KB. Complete Customs documentation in the EU UK Transport of art within the EU No specific documentation is required if an EU Country importing OR exporting AND the art remains within the EU.

Please ensure that you check for items that could be prohibited or restricted.

Cn23 Customs Form Guide Post Office

What Are The Cn22 And Cn23 Customs Declarations And How To Use Them

The Customs Form Made Easy Step By Step Guide For Cn23 Byrd

What Is A Customs Declaration Cn23 And How To Complete It Edgectp

What Is A Customs Declaration Cn23 And How To Complete It Edgectp

Posting Komentar untuk "cn23 form uk"